how does doordash report to irs

If you keep track of your earnings and expenses as you go and set aside the 153. While DoorDash doesnt send its drivers W-2 tax forms it does send them 1099-NEC forms and reports drivers income to the IRS.

Does Doordash Track Mileage What Delivery Drivers Need To Know

In this way Does DoorDash.

. If youre driving to a restaurant from your house with a pickup active then those are able to be written. Dashers use IRS tax form 1040 known as Schedule C to report their profit and business deductions. You will receive your 1099 form by the end of January.

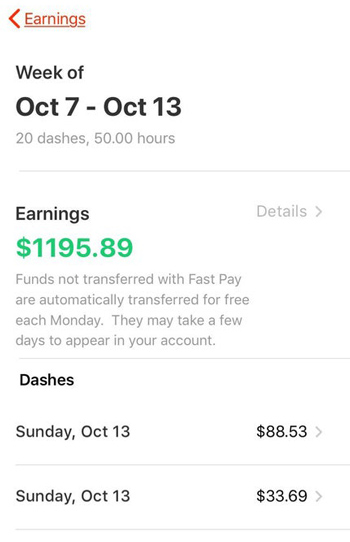

Analysts on average expect DoorDashs DASH 463. Many people think gig work is under-the-table and tax-free. Log into your checking account every pay day and put at least 25 of your dd earnings in savings.

You will be provided with a 1099-NEC form by Doordash once you start working with them. Doordash does report any income earned by employees or drivers to the IRS. So if you forgot to track mileage.

If you didnât select a delivery method on your. DoorDash sends Dashers an email when its approaching tax season with an estimate of how many miles they drove for that year. Driving to a hotspot and driving home from a hotspot are not miles you can write off.

How does DoorDash report to IRS. Heres the short answer not all payments are reported to your states unemployment office. Doordash also sends out 1099 forms to Dashers informing them how much total earnings were reported to the IRS.

Since dashers are treated as business owners and employees they have taxes. At the end of every quarter add up your. What is reported on the 1099-K.

Is scheduled to report third-quarter earnings Thursday afternoon after the close of markets in the US. If Doordash drivers made less than 600 Doordash is not. Nonetheless at the end of the fiscal year it issues a.

Grubhub Uber Eats Doordash Instacart and others report our earnings to the IRS through a 1099 form. DoorDash will send you a 1099 form at. Whether the payee vendor or contractor receives a 1099-K or not they are still required to report that income to the IRS and pay taxes accordingly.

You do not get quarterly earnings reports from dd. You might receive a Form 1099-NEC. Beginning with the 2020 tax year the IRS requires DoorDash to report Dasher income on the new Form 1099-NEC instead of Form 1099-MISC.

In 2020 the IRS has mandated that DoorDash report Dasher income on the new Form 1099-NEC rather than the Form 1099-MISC. Yes DoorDash does report its dashers earnings to the IRS since it provides its drivers with 1099-NEC forms. DoorDash drivers are not full-time employees of the company which means that DoorDash does not withhold taxes from your income.

However Doordash issues a 1099 form at the end of each tax year if you make more than. Answering the question Does Doordash report to the IRS. Yes the payouts of this company are noted to an official unemployment branch but only if a certain amount is reached.

2 days agoDoorDash Inc.

How To Get Your 1099 Tax Form From Doordash

How Couriers File Their Taxes All Your Food Delivery Tax Questions Answered Courier Hacker

Doordash Taxes Schedule C Faqs For Dashers Courier Hacker

Irs Really Be Hating On The Grind R Doordash

How Do Food Delivery Couriers Pay Taxes Get It Back

Doordash 1099 How To Get Your Tax Form And When It S Sent

How To Get Doordash Tax 1099 Forms Youtube

When Manually Tracking Mileage For Doordash Uber Eats Uber And Lyft Do You Have To Record Where You Drove How Much Detail Is Required From The Irs Quora

Doordash Taxes Made Easy Ultimate Dasher S Guide Ageras

What Is An Irs Schedule C Form

Doordash Filing 1099 Taxes The Process Youtube

How To File Taxes As An Independent Contractor Everlance

See The Latest Data On How Much Doordash Drivers Actually Make Ridesharing Driver

Doordash Taxes And Doordash 1099 H R Block

Does Doordash Track Mileage What Delivery Drivers Need To Know